In this modern era, I still can’t believe that we can still experience virus pandemic outbreak which is the COVID-19. As of this time, it has been announced that here in our country there are a total number of 64 confirmed cases of COVID-19 and 1 mortality. The Department of Health (DOH) is doing their best to detect and inform the public the health preventive measures to avoid the transmission of the virus itself. As of March 13, 2020, our President already announced that Metro Manila will be placed under community quarantine from March 15 to April 14, 2020.

With the recent developments in COVID-19, GCash ensures the safety and mitigation of exposure of Filipinos to items which may carry the virus. Recently, I’ve read an article from World Health Organization (WHO) that says paper money can carry the viruses and bacteria that they contract with, including the deadly COVID-19. In addition to that, banknotes can harbor the deadly virus for several days and the human coronaviruses stay on the surface of the paper for as long as nine days at room temperature. That’s why health experts suggest to regularly wash our hands and sanitize whenever handling money.

The bad news about the Coronavirus is currently there is no vaccine for prevention and cure for it. It is understandable to be anxious about the outbreak but by strictly following the health experts advice, you don’t need to worry. Aftrerall, we all have the responsibility to protect ourselves as well as the others.

What are the ways to prevent the transmission of COVID-19

- Wash your hands with soap and water

- Maintain at least 1 meter distance from anyone coughing and sneezing

- Avoid physical contact when greeting

- While sneezing, cover you mouth and nose with a disposable tissue or by using your inner elbow

- Avoid touching your eyes, nose and mouth

- Stay at home and seek medical attention if feeling unwell.

- Opt to cashless payment

As I mentioned earlier, paper money is dirty and can harbor countless of germs. It is one of the primary reason why I prefer cashless payments and I’ve been grateful that this technology made it easier by GCash.

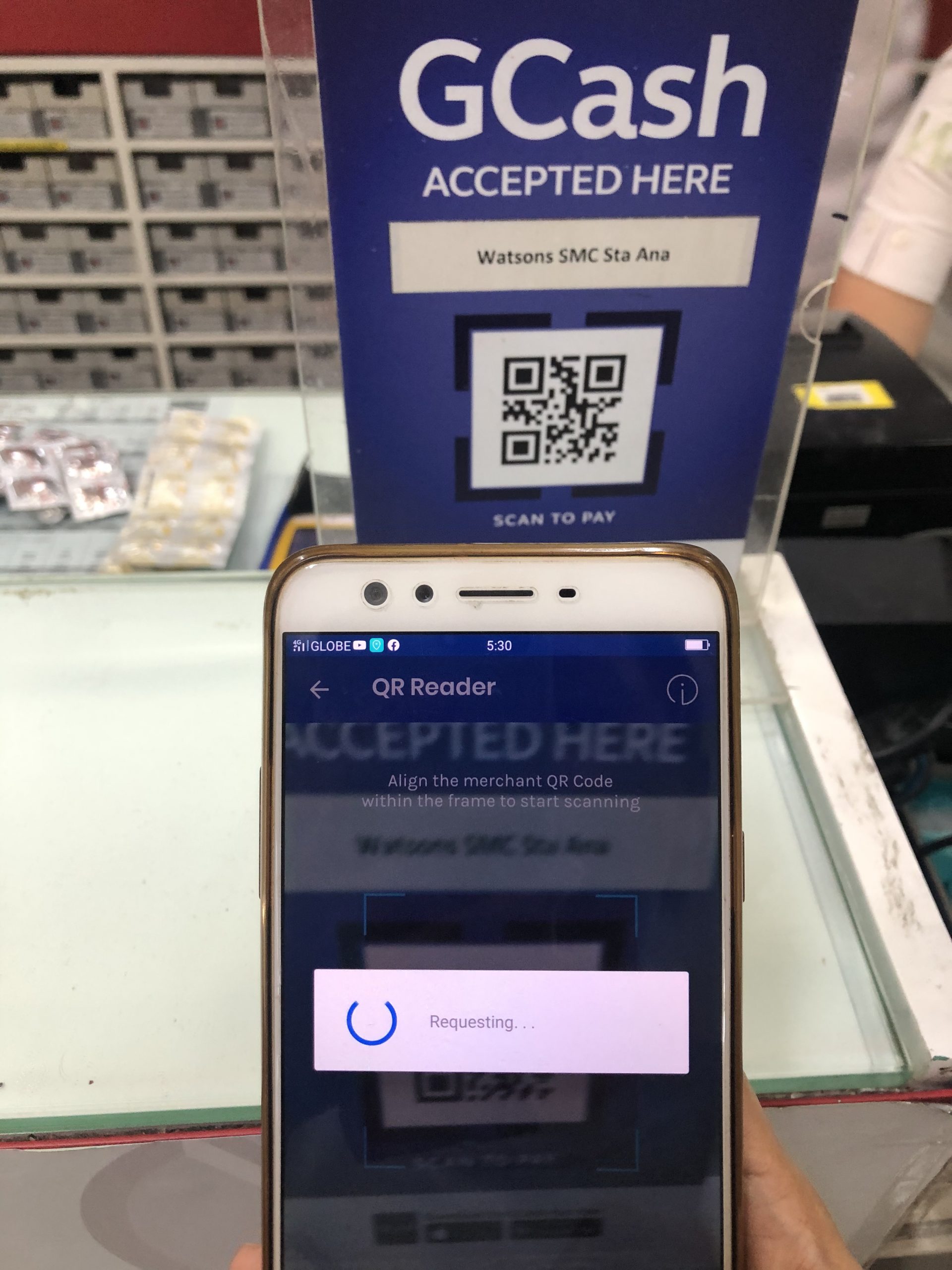

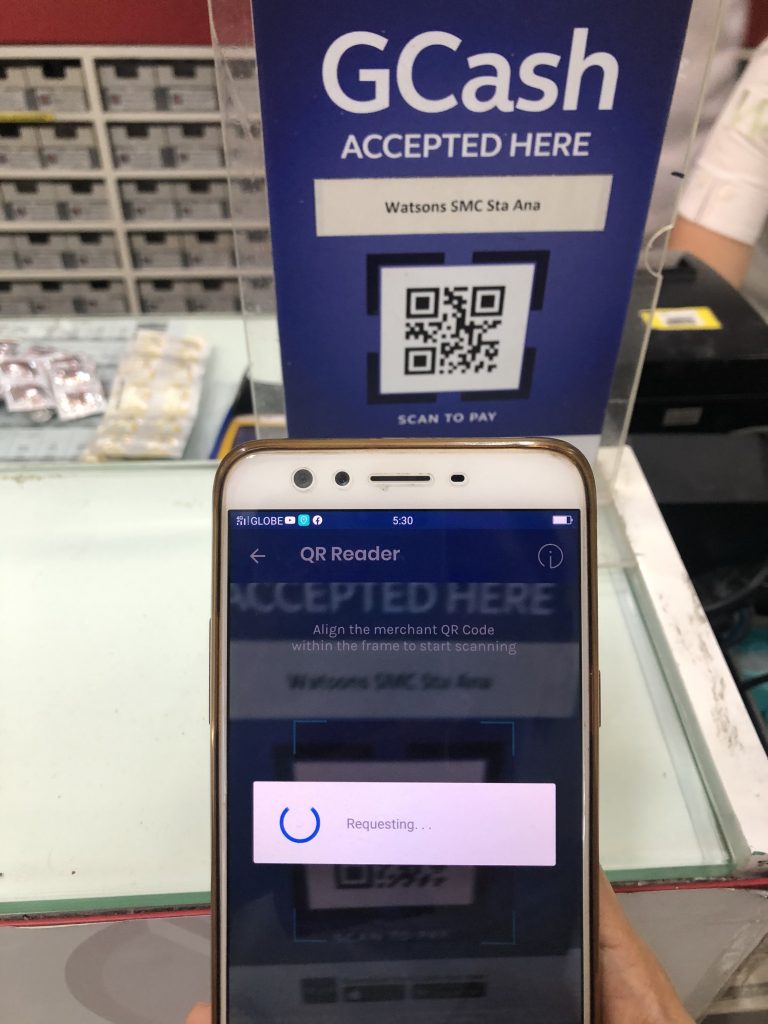

There are two types of Scan-To-Pay (STP) feature of the GCash app. The first one is the Scan-To-Pay via Barcode Payment System. To use the Scan-To-Pay via Barcode, users need only to generate a unique barcode via GCash apps and have the cashier scan the code via the scanner guns. The second and simpler option (for me because this is I often use) is the Scan-To-Pay using the GCash QR code. All you need to do is scan the participating merchant’s QR code, input the amount and then confirm payment.

The GCash’ Scan-To-Pay feature will be beneficial for both the user and merchants because it reduces the risk if transmission of virus that is always connected to cash handling. You can also manage your finances because you can easily track your savings and finances because the GCash app has the history of your transactions.

Truly, GCash helps Filipinos to experience seamless and hassle-free cashless shopping experience using their smartphones. GCash has been my go-to application not just by paying bills online but also when transacting to physical stores because they already have over 70,000 merchants nationwide.

Getting a GCash account is easy, all you need to do is download the GCash app for FREE from the App store or Google Play. You can also sign up for an account or look for @gcashofficial on Messenger.

To cash-in on your GCash account, just visit the GCash partner outlets nationwide, like Puregold branches or link your bank account in the app. Don’t worry about using your online bank because every time you cash-in it generates a code and send it to your number.

For more details about GCash and it’s Scan-To-Pay features, visit the official Facebook Page at http://www.facebook.com/gcash.