Too much of something is bad; to have nothing is just as hard.

Have you been caught up in a tug-of-war between enjoying life to the fullest and denying yourself happiness and pleasure for the sake of saving for the future?

Millennials who live by the YOLO (You Only Live Once) and FOMO (Fear of Missing Out) philosophies would probably argue that life’s too short not to have fun and get the things that we want. But this mantra has driven them to splurge more than necessary, draining their bank account in the process.

A recent study on millennials and social spending has showed how such mindset has taken a toll on the younger generation’s spending habits and financial health. The survey, commissioned by Credit Karma, an American multinational personal finance company, said nearly 40 percent of millennials have spent money they didn’t have on things or adventures and went into debt to keep up with their peers.

Enjoying life to the fullest without regard for the consequences later may sound appealing. You may also agree that all work and little or no play has a negative impact on quality of life and one’s overall well-being. So how do we strike a balance between having fun (because we only get to live one lifetime after all) and saving money for the rainy day?

Here are some quick tips on how we can YOLO/FOMO and still achieve financial balance:

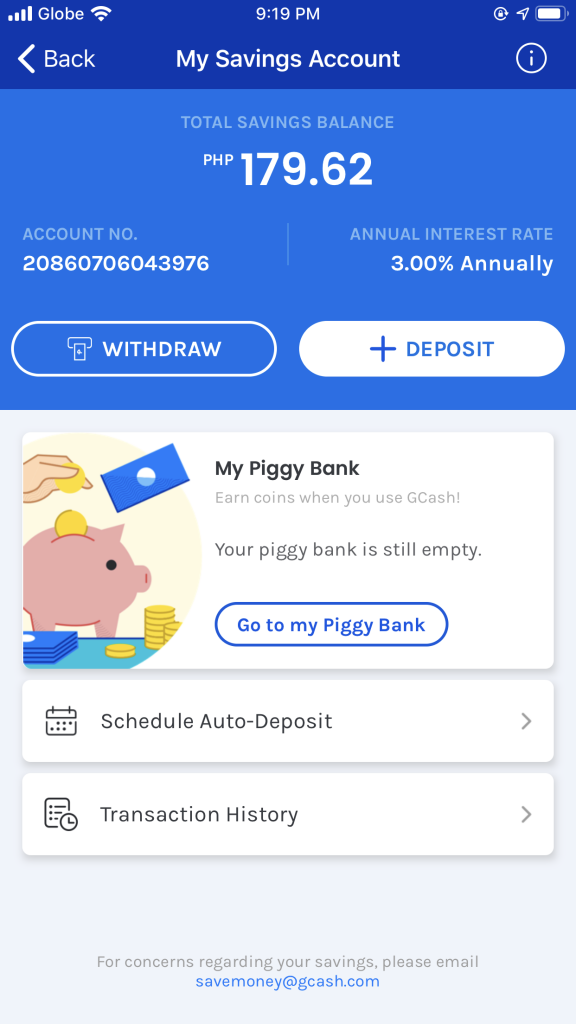

Save with a digital wallet app.

Leading mobile wallet GCash has a feature that lets users open and maintain a bank account straight from the app. Called GSave, it is a simpler alternative to traditional banking, without the cumbersome requirements of opening an account. It requires no minimum deposit or a maintaining balance. It also offers a higher interest rate—at 3% annually. GCash has recently launched #LetsSaveTogether to encourage Filipinos to translate #PlsSaveMe conversations about being broke into actions of saving and practicing good spending habits by taking advantage of the GSave feature. The ideal way to saving money is to follow the 50-30-20 rule, wherein we save 20% of our net income for emergency fund and our retirement account.

Create a YOLO/FOMO fund.

This is money set aside for our YOLO/ FOMO fix when it hits. This fund can be for holiday trips, vacations, concerts, music festivals, fun run, dining escapades, and expensive activities like scuba diving, hiking and surfing, among others. Setting up a separate account will prevent us from touching our retirement savings and splurging recklessly.

Mute and Unfollow on Social Media.

Social media has been a driving force of millennials’ YOLO and FOMO behavior. Every day we get reminders (deals, sales, discounts) from Facebook and Instagram of the next best items we should be “adding to cart.” To resist temptation, we could mute and unfollow accounts that make us feel pressured to keep up and spend more than we are earning.